Don't Wait, Enroll Today

IMPORTANT: If you do not elect your benefits during the annual Open Enrollment period or within 31 days of your date of hire, you will not have Roper St. Francis Healthcare health plan coverage until the next year unless you have a qualified life event as defined by the IRS.

HAVE A QUESTION?

Have a Question? Call the HR Service Center at 888-691-5729 or go to https://bsmhealth.service-now.com/hrportal

What’s New for 2024

Roper St. Francis Healthcare is pleased to provide affordable benefit options that meet the needs of you and your family. We hope that you take full advantage of these benefits as part of your Total Rewards package.

RSFH is making a considerable number of enhancements and modifications to your benefits for 2024. We encourage you to pay close attention to all related announcements to make the best decisions during Open Enrollment.

Below is a high-level summary of what Benefit programs are changing as well as what is staying the same for the coming year.

General Open Enrollment Information

Open Enrollment will be Oct. 12-26.

HOW TO ENROLL

All benefit elections must be submitted online through www.rsfbenefits.com. Enrolling by telephone is NOT an option. You also can download the Benefitplace app to complete your enrollment on your mobile device. Use the code “RSFBenefits.”

Use “RSF” plus your employee number (ex. RSF00000) as your username and your date of birth as your password in this format: the two-digit date of your birth followed by the first three letters of your birth month followed by the four-digit year of your birth (ex. 08Jun1976).

IMPORTANT

- Your 2023 elections for Health Savings Accounts, Health Care Flexible Spending Accounts and Dependent Care Flexible Spending Accounts do NOT carry over, so you must actively enroll in these plans if you want to participate in 2024.

- See the LIFE, SHORT-TERM DISABILITY, LONG-TERM DISABILITY, and VOLUNTARY BENEFITS section below for important information about changes to these plans. You should actively review your coverage options and confirm your elections for these plans.

- If you do not make changes to your 2023 elections for medical, dental and vision, your current elections will carry over for 2024.

ELIGIBILITY

The requirements for a teammate to be benefit eligible will be more generous for 2024. Please see chart below for details:

| Plan | Old Requirement | New Requirement |

| Medical | 40 + hours per pay period (0.5+ FTE) | 30 + hours per pay period (0.375+ FTE) |

| Dental | 40 + hours per pay period (0.5+ FTE) | 30 + hours per pay period (0.375+ FTE) |

| Vision | 40 + hours per pay period (0.5+ FTE) | 30 + hours per pay period (0.375+ FTE) |

| Flexible Spending Accounts | 40 + hours per pay period (0.5+ FTE) | 30 + hours per pay period (0.375+ FTE) |

| Health Savings Accounts | 40 + hours per pay period (0.5+ FTE) | 30 + hours per pay period (0.375+ FTE) |

| Short Term Disability | 40 + hours per pay period (0.5+ FTE) | 30 + hours per pay period (0.375+ FTE) |

| Long Term Disability | 64 + hours per pay period (0.8+ FTE) | 60 + hours per pay period (0.75+ FTE) |

| Life Insurance | 64 + hours per pay period (0.8+ FTE) | 30 + hours per pay period (0.375+ FTE) |

| Supplemental Life Insurance | 64 + hours per pay period (0.8+ FTE) | 30 + hours per pay period (0.375+ FTE) |

| Spouse/Child Life Insurance | 64 + hours per pay period (0.8+ FTE) | 30 + hours per pay period (0.375+ FTE) |

Medical (Administered by BlueCross BlueShield (BCBS))

We are pleased to maintain our current medical plan design offerings for 2024. The following medical plans continue to be available:

- Alliance Prime (plan generally limited to only RSF Health Alliance network coverage)

- Alliance Flex (plan with RSF Health Alliance, BlueCross BlueShield and an Out of Network coverage option)

- Alliance Save (high deductible plan plus a Health Savings Account with RSF Health Alliance, BlueCross BlueShield and an Out of Network coverage option)

- Alliance Out of Area (for those who live outside the Tri-County area)

For all these plans, using the Roper St. Francis Health Alliance network of providers will ensure the lowest copays and co-insurance. But if you have dependent(s) who live outside of the Tri-County area, you should consider enrolling in a plan that has other network options available, too.

The cost of insurance and healthcare continues to rise and affect employers nationwide. The new rates for 2024 will vary, but on average, teammate payroll contributions for the medical plans will increase by slightly less than 3 percent.

The difference between Qualified and Non-Qualified rates continues to be standardized across plans and coverage tiers. Teammates hired or rehired in 2023, teammates who moved from non-benefit eligible to benefit eligible in 2023, and teammates who experienced a Qualifying Life Event that prompted them to add teammate medical coverage during 2023, are automatically considered Qualified for purposes of Open Enrollment for 2024.

Flexible Spending Accounts/Health Savings Accounts (Administered by Optum Financial, formerly known as ConnectYourCare)

Your 2023 elections for Health Savings Accounts (HSA), Health Flexible Spending Accounts (both regular and Limited Purpose) and Dependent Care Flexible Spending Accounts do NOT carry over, so you must actively enroll in these plans if you want to participate in 2024.

RSFH will continue to make an annual contribution into a teammate’s Health Savings Account if they elect the Alliance Save plan as follows: $550 for teammate only coverage; $825 for teammate and spouse coverage; and $1,100 for teammate and child(ren) or family coverage. The IRS has increased the HSA contribution limits modestly for 2024. The annual limit on HSA contributions (including contributions from RSFH) will be $4,150 for teammate only coverage and $8,300 for family coverage. Teammates who are age 55 or older may make up to an additional $1,000 in catch-up HSA contributions.

The maximum contribution limit for Health Flexible Spending Account for 2024 will be $3,050. The maximum contribution limit for Dependent Care FSA remains $5,000.

Pharmacy (Administered by MedImpact)

All medical plans will include prescription drug coverage administered by MedImpact.

The pharmacy plan design remains largely unchanged; however, the grace period to move from retail to Harness Health mail order pharmacy for maintenance medications is being shortened from two fills to one fill.

The formulary is reviewed periodically, and the most current one is available to view on MedImpact’s consumer portal.

Many employers are excluding expensive weight loss medications. RSFH continues to cover this class of drug; however, weight loss medications like Wegovy and Saxenda continue to be case managed by RSFH’s bariatric specialists, and the prior authorization requirements for new starts for these medications are being further restricted. These drugs will only be available through Harness Health mail order pharmacy in 2024, and will be subject to 40 percent coinsurance which will not be applied to the plan’s deductible or out of pocket maximum.

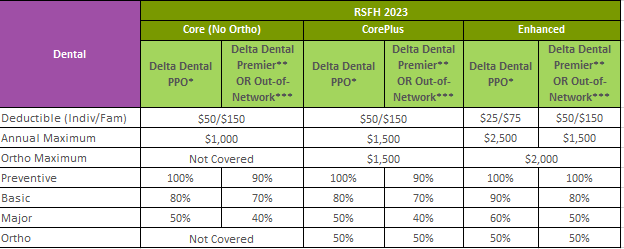

Dental (Administered by Delta Dental of Ohio)

RSFH continues to partner with Delta Dental of Ohio to offer three different plans from which to choose: Core, CorePlus and Enhanced. Please see the chart below as an overview for the coverage offered under each plan. Note that both the CorePlus and Enhanced plans include orthodontia benefits for teammates, spouses and covered dependent child(ren). Premiums vary according to the plan you select.

All three dental plans allow you to visit any dentist you like but there are advantages to choosing a dentist in one of Delta Dental’s two networks: Delta Dental PPO and Delta Premier. You’ll likely save more money and have more insurance coverage when you visit a Delta Dental PPO dentist. If you visit a dentist who does not participate in Delta Dental PPO, you can still save money if that dentist participates in Delta Premier. If you elect to use a dentist that is not in the Delta Dental network (Delta Dental PPO or Delta Premier) there are some items you need to consider:

- Delta Dental of Ohio will send claim payments directly to you (not your dentist) and you are then responsible for making full payment to your dental provider.

- Out-of-network coverage levels apply.

- Balance billing is possible. This means you are responsible for any difference between Delta Dental’s payment and the amount charged by your out-of-network dentist.

*Delta Dental PPO offers deepest discount and no balance billing

**Delta Dental Premier offers less discount and no balance billing

***Out-of-Network applies to nonparticipating dentists and balance billing is possible

To confirm the status of your dentist or find a Delta Dental PPO or Delta Premier dentist, visit www.deltadentaloh.com/findadentist.

Vision (Insured by Physician’s Eyecare Plan)

There are no changes to the vision plan, but RSFH was able to reduce teammate premiums for 2024. To learn more about the Physicians Eyecare network, visit www.physicianseyecareplan.com.

Voluntary Benefits

RSFH is offering an expansive new voluntary product line through BenePlace. The following new programs will be available during open enrollment for 2024, or upon a qualified life event:

- Critical Illness (MetLife)

- Accident Insurance (MetLife)

- Hospital Indemnity (MetLife)

- Life with Long Term Care (Chubb)

- Identity Protection (Allstate/Aura)

- Legal (LegalShield)

In addition, the following new offerings will be available in January 2024. You will not need to wait until open enrollment or a qualified life event to enroll directly with the carriers for the plans below.

- Choice Auto/Home (Farmers)

- Pet Insurance (Nationwide)

- Travel Insurance (Allianz)

If you are already enrolled in the 2023 critical illness and/or accident insurance plans through The Hartford, please note that such coverage will terminate effective December 31, 2023. You may choose to enroll in the new voluntary plan offerings for critical illness or accident insurance, but you must make an active election during open enrollment.

If you are already enrolled in the 2023 universal life insurance plan, Transamerica will send you a notice which provides an option to maintain your existing coverage (known as a portability option) with direct payments to Transamerica. If you do not actively elect to port your coverage, it will end December 31, 2023. Alternatively, you can consider enrolling in the Chubb Term Life Insurance with Long Term Care during open enrollment.

Life Insurance/Accidental Death & Dismemberment Benefits (New for 2024: Insured by Sun Life)

Basic life insurance and accidental death and dismemberment benefits will be insured by Sun Life beginning January 1, 2024, instead of The Hartford. Some enhancements have been made to plan design. Part-time and full-time teammates will be eligible for 1X base annual earnings for Life insurance and AD&D.

These benefits continue to be made available at no cost to you. Eligible teammates will automatically be enrolled in the life insurance and accidental death and dismemberment benefits for 2024.

Teammates should actively review their new options for supplemental and dependent life insurance/AD&D. Supplemental life insurance/AD&D is available for teammates from 1X to 6X base annual earnings. There will be a combined maximum between Basic Life and Supplemental Life of $2,500,000. The guaranteed issue is being raised to the lesser of $2.5M or 2X base annual earnings. Guaranteed issue means that teammates can enroll in this amount of coverage without providing evidence of insurability based on their health condition. Sun Life has agreed to allow teammates already currently enrolled in 3x or 4x to maintain those elections without evidence of insurability.

Spouse life insurance was previously limited to $10,000, but now teammates can elect up to $100,000 (in increments of $10,000). Evidence of insurability is not required for amounts of $30,000 or below. Child life insurance was previously limited to $5,000, but now is available up to $15,000 (in increments of $5,000).

Disability Benefits (New for 2024: Insured by Sun Life)

As a new benefit, RSFH is paying the full cost of Short-Term Disability coverage for part-time and full-time teammates working 15 hours/week or greater. RSFH is also paying the full cost of Long-Term Disability coverage for full time teammates working 30 hours/week or greater. Eligible teammates will automatically be enrolled in the 100 percent employer paid disability plan(s).

The Short-Term Disability insurance program provides income protection to part-time and full-time teammates who are unable to work due to a covered illness or injury. After a one-week elimination period, short-term disability pays 60 percent of the teammate’s base weekly earnings for up to 26 weeks. PTO may be used to cover the days out during the elimination period.

Full-time teammates also receive at no cost Long Term Disability which provides income protection for those who are unable to work for an extended period of time due to a covered sickness or injury. Long Term Disability benefits begin after a 180 day elimination period (after short term disability) and pays 60 percent of your base monthly earnings up to $15,000 a month while disabled.

While these coverages will replace Extended Illness Hours (EIH), no one will lose the EIH they have accrued as of pay period ending Dec. 16, 2023. RSFH will convert these hours into dollars and freeze your EIH bank and allow you to use it during Short-Term Disability to “top off” or cover the 40 percent difference between 60 percent of base earnings and 100 percent of base earnings. PTO may also be used to “top off” in the same manner if/when the EIH bank is exhausted.

Teammates who are absent for more than 3 consecutive calendar days due to an injury or illness must be on an approved medical leave of absence.

Holidays (New for 2024!)

Roper St. Francis Healthcare recognizes the same eight paid holidays as follows:

| Holiday |

| New Year’s Day |

| Martin Luther King Day |

| Good Friday |

| Memorial Day |

| Independence Day |

| Labor Day |

| Thanksgiving Day |

| Christmas Day |

While the holidays have not changed, in 2024 there will be a separate Holiday benefit that is not deducted from PTO hours. Full-time teammates budgeted to work 30 or more hours per week will be eligible to receive up to eight hours of Holiday pay for each holiday. Holidays will be paid in the pay period they occur. Teammates may opt to work the holiday and take an alternative day off within the same pay period with manager approval.

Part-time teammates will not be eligible for the new Holiday benefit; however, RSFH will provide 100% PTO credit in year 1 for the holiday hours that are lost and 50% credit in year 2 to help with the transition.

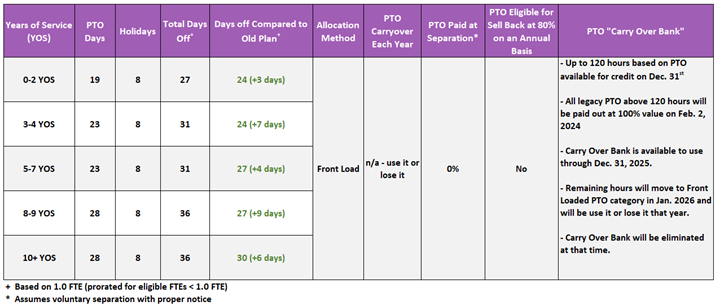

Paid Time Off (PTO) for Exempt (Salaried) Teammates in 2024 — No One Will Lose PTO!

Full- or part-time teammates (budgeted to work at least 15 hours a week) are eligible for PTO. The amount of PTO available is still based on years of service, and provides higher time off benefits for those who have been loyal to RSFH over time.

- RSFH is changing to a non-accrual, use it or lose it plan. This means exempt teammates will receive the full allotment of days at the beginning of the year. There is no carry over balance after the transition period.

- Since hours are front loaded and must be used by the end of the year, PTO hours are not paid out if/when a teammate separates employment with RSFH.

- When you add the number of PTO days to Holiday days available, no exempt teammate will lose time off based on these buckets.

- Some exempt teammates will gain more days off based on years of service.

Transition Period (for benefit eligible teammates hired on or before Dec. 16, 2023)

To transition teammates to this new PTO plan, RSFH will create a separate “carry over” bank where exempt teammates will be able to “carry over” up to 120 hours of PTO and use it over the next 2 years. The process will be:

- On December 31, 2023, PTO banks will be credited with their front-loaded PTO amount for the year.

- At the same time, a separate “carry-over” bank will be created where the teammate’s old PTO will be credited up to 120 hours.

- All legacy PTO amounts greater than 120 hours will be paid out at 100% on February 2, 2024. This payment is taxable wages; subject to tax withholdings; and will be processed as a separate deposit.

- The legacy “carry over” bank must be used by December 31, 2025. At the end of the transition period, the remaining hours will be added to the regular front-loaded PTO bank and must be used by the end of the year, or they will be lost.

- In the event a teammate leaves the organization, these carry-over bank hours will be eligible for pay out based on years of service. The use it or lose it hours will not be paid out upon separation.

PTO Donation

PTO Donation

For exempt teammates that elected to donate PTO in 2023 as part of the 2024 RSFH Gives! campaign, your legacy PTO balance will be used for this donation and processed in the pay period ending January 13, 2024.

Beginning In 2024, exempt teammates will not be able to use their PTO bank for donations to other teammates in need or to the RSFH Foundation for future RSFH Gives! campaigns.

- While you cannot donate PTO, you can still participate in the RSFH Gives! campaign through payroll deductions.

- You can also direct payroll giving to the RSFH Teammate Hardship Fund if you want to donate to teammates in need.

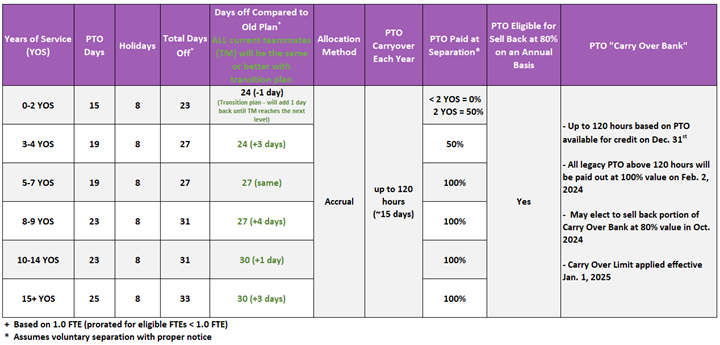

PAID TIME OFF (PTO) FOR NON-EXEMPT (HOURLY) TEAMMATES IN 2024 – NO ONE WILL LOSE PTO!

Full- or part-time non-exempt teammates (budgeted to work at least 15 hours a week) are eligible to accrue PTO based on hours paid. The amount of PTO available is still based on years of service and provides higher time off benefits for those who have been loyal to RSFH over time.

- Accrual rates for PTO are based on most recent hire date or acquisition date (instead of most recent benefit-eligible date) and the total hours paid up to 80 hours per pay period.

- As long as teammates stay in a benefits-eligible position, they may carry over their PTO bank from year to year, up to the maximum accrual.

- The maximum accrual will be reduced to 120 hours for both full-time and part-time teammates; however, see notes below regarding the transition period.

- Each year, non-exempt teammates will have an opportunity to cash-out one time at 80% value

- PTO hours will be paid out if/when a non-exempt teammate separates employment (assuming voluntary separation with proper notice) based on years of service:

- Less than 2 years: 0%

- 2-5 years: 50%

- 5+ years: 100%

Transition Period (for benefit eligible teammates hired on or before Dec. 16, 2023)

- All legacy PTO amounts greater than 120 hours will be paid out at 100% on February 2, 2024. This payment is taxable wages; subject to tax withholdings; and will be processed as a separate deposit.

- During 2024, the combination of your legacy PTO and your newly accrued PTO will be allowed to exceed the new 120 hour maximum accrual; however, the legacy PTO hours that are carried over into 2024 must be either used by the end of the calendar year, or there will be an opportunity in October 2024, to cash out the excess up to 80 hours at 80% value.

- Beginning 2025, all teammates will be subject to the 120 hours carry over limit with an annual opportunity to cash out up to 80 hours of PTO at 80% value.

- Where there are differences on the annual PTO accrual rate based on your years of service an additional allotment of PTO will be credited to your account to keep teammates whole.

PTO Donation

PTO Donation

For non-exempt teammates that elected to donate PTO in 2023 as part of the 2024 RSFH Gives! campaign, your legacy PTO balance will be used for this donation and processed in the pay period ending January 13, 2024.

In 2024, non-exempt teammates will continue to be able to use their PTO bank for the RSFH Gives! campaign as well as participate through payroll deductions. However, you will no longer be able to donate PTO to other teammates in need. You may elect to direct payroll giving to the RSFH Teammate Hardship Fund if you want to donate to teammates in need.

PARENTAL LEAVE PROGRAM (New in 2024)

Welcoming a new child to your family is an important milestone, and we recognize the need to dedicate your full attention to your family. With that in mind, we’re proud to offer Parental Leave. This benefit allows eligible teammates to take up to 8 weeks of continuous time away from work at 100% pay to bond with the new arrival to your family.

Birth and Non-Birth parents working full- or part-time may be eligible for Parental Leave.

For the birth parent, Parental Leave will begin after the disability period ends. Disability periods for maternity are generally 6 weeks for a vaginal delivery and 8 weeks for a caesarean section delivery. The non-birth parent must take paid parental leave at the time of their child’s birth. Paid Parental Leave is also available at the date of finalized legal adoption for those teammates who adopt a child. Short-term disability and Parental Leave run concurrently with any Family and Medical Leave Act (FMLA) leave.

Mission Leave (New for 2024)

To support teammates who want time to participate in humanitarian projects, RSFH will offer a new Mission Leave program. Teammates in good standing may take off up to two weeks off one time per year for Mission Leave.

We are honored to provide this leave that is aligned with Roper St. Francis Healthcare’s mission of healing all people with compassion, faith and excellence!

Supplemental Military Pay Program (New for 2024)

Supplemental Military Pay will be available to full-time teammates after 14 days of continuous active military duty. This pay is intended to keep the teammate whole when a pay discrepancy exists between the current role and deployed role. Leave and Earnings Statement will be required to support requests to receive Supplemental Military Pay.

We are honored to provide this new program to our RSFH heroes who serve!

Thank You!

We believe that by investing in our benefits plans, we are investing in you and your families. We want you to have access to affordable coverages and excellent care. Thank you for all that you do to live our mission at RSFH!

QUESTIONS?

Contact the HR Benefits Team at HRBenefitsTeam@rsfh.com or 843-720-8400, Option 2.