Don't Wait, Enroll Today

IMPORTANT: If you do not elect your benefits during the annual Open Enrollment period or within 31 days of your date of hire, you will not have Roper St. Francis Healthcare health plan coverage until the next year unless you have a qualified life event as defined by the IRS.

HAVE A QUESTION?

Have a Question? Call the HR Service Center at 888-691-5729 or go to https://bsmhealth.service-now.com/hrportal

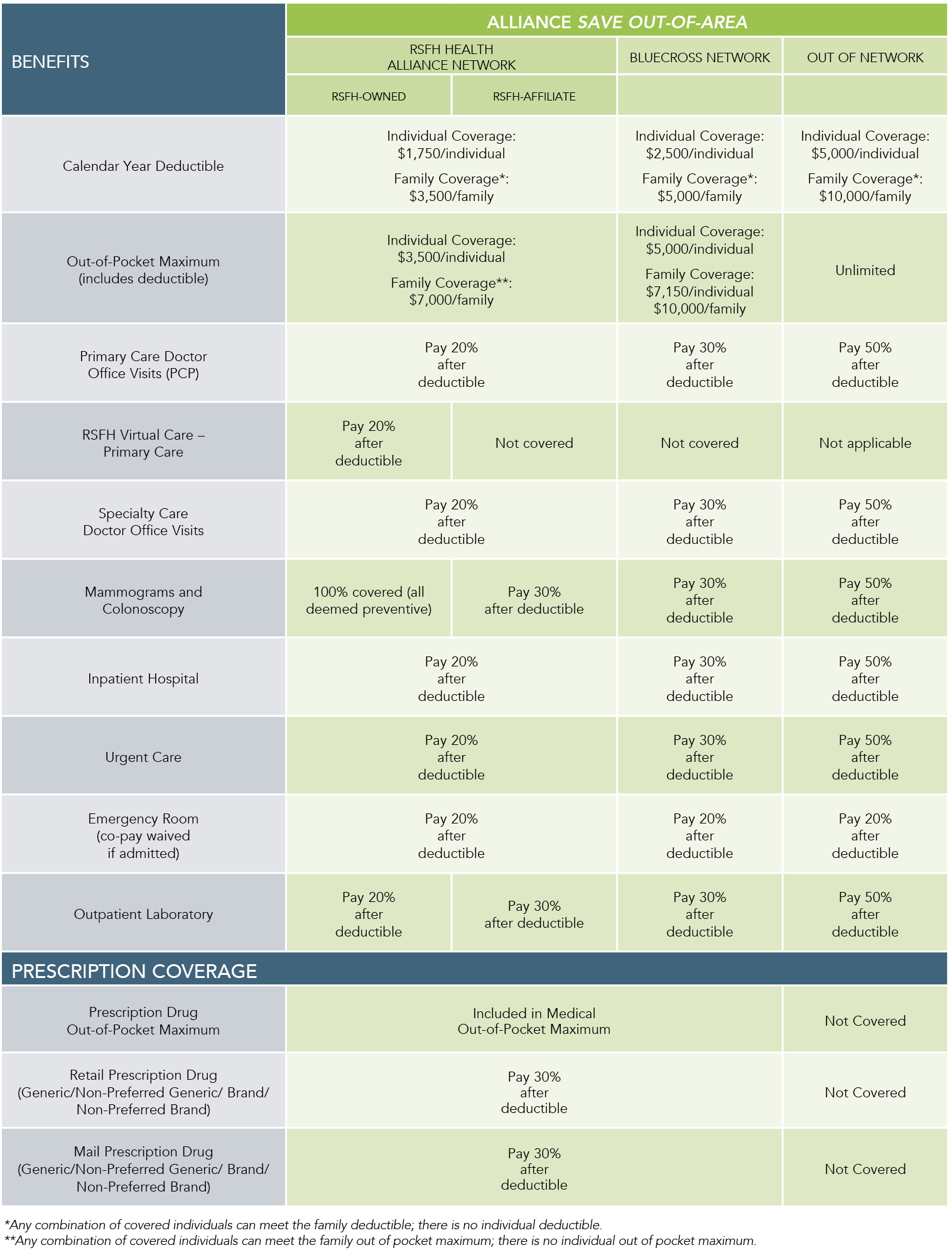

Alliance Save Out-of-Area

The Alliance Save Out-of-Area plan is specifically designed for those teammates who live outside of the Tri-County area (Berkeley, Dorchester and Charleston counties). You still have the same comprehensive protection and provider network as our Alliance Prime and Alliance Flex plans. You also gain greater control over your medical expenses.

The Alliance Save Out-of-Area plan is a high-deductible health plan option that also enables you to save toward your healthcare expenses in a tax-advantages Health Savings Account (HSA). Roper St. Francis Healthcare will contribute up to $1,100 into your HSA.

Coverage for Frequently Used Services - Alliance Save Out-of-Area

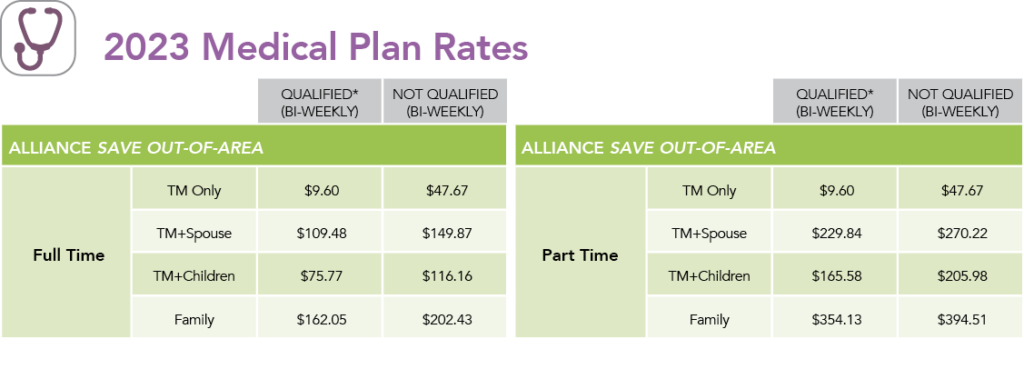

Contribution Rates -- Alliance Save Out-of-Area

2024 Rates

* Teammates with a hire date, status change, or life event with an effective date from January 1, 2024, through December 31, 2024, will default to the Qualified status for enrollment in the 2024 and 2025 medical plans.

2023 Rates

* Teammates with a hire date, status change, or life event with an effective date from January 1, 2023, through December 31, 2023, will default to the Qualified status for enrollment in the 2023 and 2024 medical plans.

* Teammates with a hire date, status change, or life event with an effective date from January 1, 2023, through December 31, 2023, will default to the Qualified status for enrollment in the 2023 and 2024 medical plans.

How much will Roper St. Francis Healthcare contribute to my HSA?

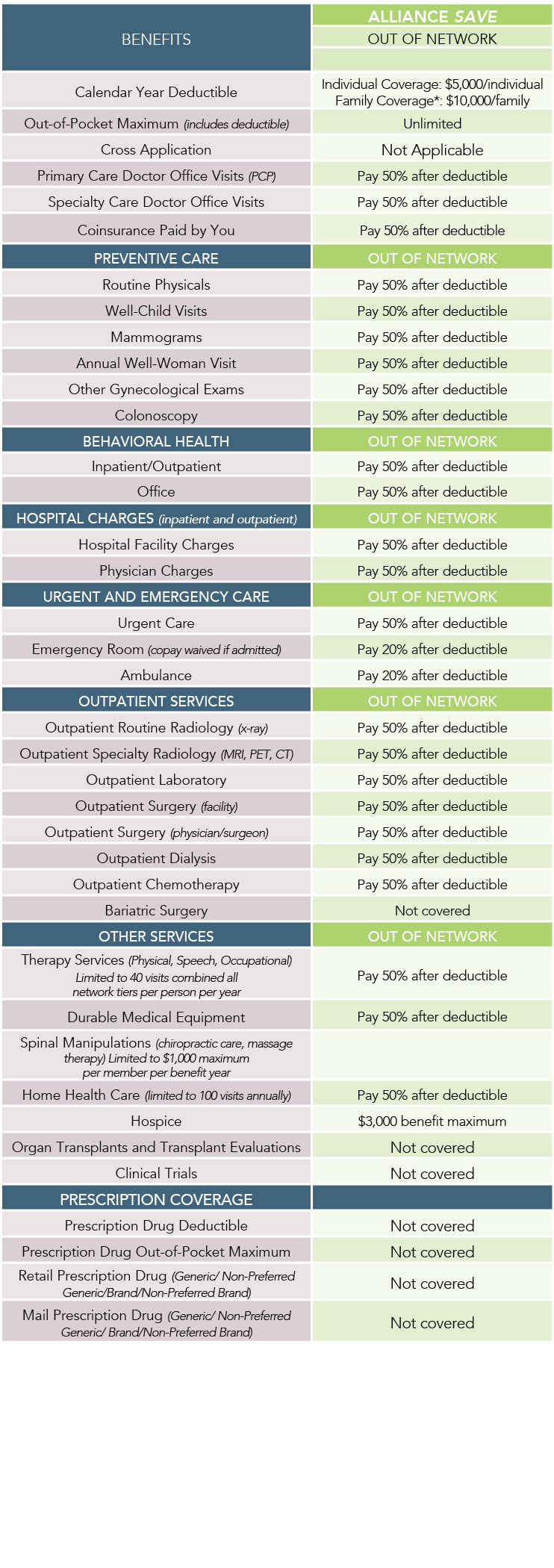

Alliance Save Out-of-Area Overview

- Can use RSF Health Alliance, BlueCross, or Out-of-Network providers. (Find a Provider.)

- You pay 20% co-insurance after deductible (when using the RSF Health Alliance network)

- You can offset your eligible medical expenses by using funds from your tax-advantaged HSA.

- Roper St. Francis Healthcare contributes up to $1,100 into your HSA.

- Out-of-pocket maximum of $3,500 individual/$7,000 all other tiers