Health Savings Account

Our 2024 Health Savings Account Administrator is Optum Financial (formerly known as ConnectYourCare). For 2025, the Health Savings Account Administrator will change to Fidelity.

When you enroll in the Alliance Save plan, you will need to open your Health Savings Account with Fidelity. Roper St. Francis Healthcare’s contribution into your HSA will be deposited into your account once it is opened. The amount of the contribution is detailed below in “How much will Roper St. Francis Contribute to my HSA?”

How much will Roper St. Francis Healthcare contribute to my HSA for 2024?

How much will Roper St. Francis Healthcare contribute to my HSA for 2025?

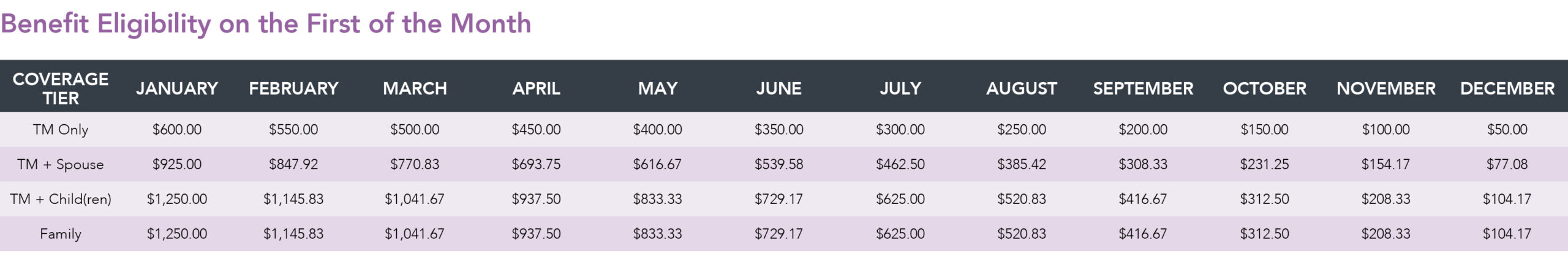

If you select the Alliance Save plan, Roper St. Francis Healthcare makes a contribution into your Health Savings Account, of up to $1,250. The contribution is pro-rated for new teammates according to the chart below. The contribution is pro-rated for new teammates according to the chart below.

Additionally, completion of Be Well requirements can earn teammates up to $600 in employer contributions to their HSA annually.

What is the maximum contribution I can make into my HSA?

The 2024 maximum HSA contribution limits (including Roper St. Francis Healthcare’s contribution) as set by the IRS are as follows:

- $4,150 single insured

- $8,300 family insured

- $1,000 55+ catch-up contribution

The 2025 maximum HSA contribution limits (including Roper St. Francis Healthcare’s contribution) as set by the IRS are as follows:

- $4,300 single insured

- $8,550 family insured

- $1,000 55+ catch-up contribution

Your pre-tax* contributions can be made at any time during the year in any increment, including the following.

- All at once at the beginning of the year

- All at once at the end of the year

- In equal amounts during the year

* Post-tax direct contributions are not allowed. However, you are able to edit your pre-tax payroll contributions at any time during the plan year.

What is a Health Savings Account?

Who is eligible for an HSA?

- A person must be covered simultaneously by a qualified HDHP.

- The HSA enrollee cannot be covered by any other health insurance plan, such as a spouse’s plan

- The HSA enrollee must not be enrolled in Medicare

- The HSA enrollee cannot be claimed as a dependent on someone else’s federal income tax return

What is allowable for HSA payments or distributions?

How do I use my HSA?

You will have access to a secure, easy-to-use web portal where you can track your account balance, view your investment accounts, and submit requests for reimbursements. You can also access your account with the mobile app.

You will also receive an HSA Debit Card to use for qualified medical expenses at doctors’ offices, hospitals, and pharmacies. When you use the card to pay for services, the payment is automatically withdrawn from your account. Just keep receipts for your own records.

Monthly statements and annual tax documents are issued for the HSA deposit account and Mutual Fund Investment Account, and can be accessed through the web portal or mailed to your address on file if elected through the portal.

In 2024, you may access your HSA through the web portal at rsfh.optumfinancial.com or through the Optum Financial mobile app. (Learn more, including download information, at Benefits Apps,)

In 2025, you may access your HSA through the web portal at nb.fidelity.com or through the Netbenefits mobile app.

What happens to my HSA if I leave Roper St. Francis Healthcare?

What happens if I use my HSA funds for non-medical expenses?

Managing Your HSA Beneficiary

For specific legal or tax implications regarding beneficiary designations, contact your legal or tax advisor.

Summary of HSA advantages

- Triple Tax Advantages – Pre-tax contributions to your HSA, tax-exempt interest and investment gains on your HSA and tax-free withdrawals from your HSA for qualified medical expenses

- Unprecedented Control – You are now in control of how your health care dollars are used – save or spend, it’s your choice

- Portability – Your HSA is an account that you own and remains in place regardless of where you work or what insurance company you are insured by

- Flexibility – Your HSA contributions can be used to pay for a wide range of eligible medical expenses not typically covered by low deductible health insurance or other health care accounts

- Planning for the Future – HSA contributions can be directed toward long-term investment vehicles, such as mutual funds, to maximize the future value of your HSA