Don't Wait, Enroll Today

IMPORTANT: If you do not elect your benefits during the annual Open Enrollment period or within 31 days of your date of hire, you will not have Roper St. Francis Healthcare health plan coverage until the next year unless you have a qualified life event as defined by the IRS.

HAVE A QUESTION?

Have a Question? Call the HR Service Center at 888-691-5729 or go to https://bsmhealth.service-now.com/hrportal

Roper St. Francis Healthcare Retirement Plan

Whether your retirement is five or 50 years away, the Roper St. Francis Healthcare 403(b) retirement plan is a valuable teammate benefit and one of the most powerful ways to enhance your long-term financial well-being. We encourage you to invest in yourself and your future by participating in this plan through Fidelity Investments.

Your retirement savings plan is an important benefit, so you need the right information, resources, and support to help you make decisions with confidence. With more than 65 years of financial services experience, Fidelity can help you put a plan in place that balances the needs of your life today with your retirement vision for tomorrow.

Retirement Plan Highlights and Frequently Asked Questions

How Do I Contact Fidelity Investments?

For service needs in addition to your RSFH Retirement Plan, stop by one of the Fidelity Investor Centers. To find the Investor Center nearest you, visit www.fidelity.com/branches/branch-locations.

How Do I Log-In To My Online Retirement Account?

- Go to www.netbenefits.com/atwork.

- Click Register as a new user at the top right.

- Follow the instructions to set up your login information.

If you already have a username and password with Fidelity, you can use your existing login information.

Why Save in the Roper St. Francis Healthcare Retirement Plan?

- Automatic savings — Your contributions are deducted directly from your pay.

- Pretax contributions — Your contributions are deducted from your pay before federal taxes, which reduces your current taxable income.

- Tax-deferred growth — The money in your account grows free from taxes until you withdraw it. You don’t have to pay taxes each year on your contributions or earnings, so there’s more money in your account to continue compounding.

Who Is Eligible to Participate in the Retirement Plan?

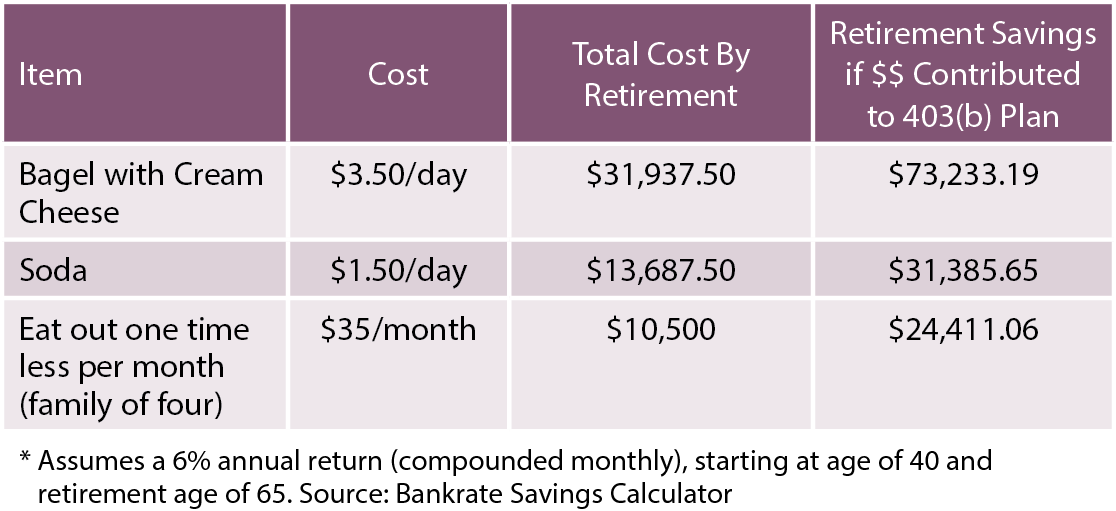

Looking for More Ways to Boost Your Retirement Savings?

Here are just a few examples: *

How Do I Update My Name or Address on My Fidelity Investments Account?

Any updates to your personal information made in the Human Resources Information System (MyHR in 2023 and Workday in 2024) are automatically updated to your Fidelity Investments retirement account after one full pay period. You do not need to contact Fidelity Investments directly to update your personal information.

How Often Can I Change My Retirement Contribution Rate?

- Log on to your account at www.netbenefits.com/atwork

- Select Contribution Amount under the Quick Links drop-down menu.